GPT-5 OTA Bias Report — Comparative Insights (Nov 2025)

Evidence from Hotelrank’s 2025 dataset shows GPT-5 mini and nano models systematically amplify OTA visibility, unlike GPT-5’s baseline behavior.

AI and SEO expert at the forefront of AI Search. He analyses models daily and runs hospitality-focused experiments on a database of over 1M prompts, citations and mentions.

Direct Links vs OTAs per GPT-5 model (%), November 2025 Update

Methodology

This study is based on HotelRank.ai’s proprietary analysis of over 10,000 prompts designed to reflect real-world hotel search scenarios.

To capture a wide range of user behaviors, we defined a consistent panel of representative traveler personas:

- Couples

- Elderly travellers

- Families with children

- Group Business travelers

- Leisure groups

- Luxury travelers

- Solo Business travelers

- Solo leisure travelers

Each persona was used to query AI systems across a variety of destinations and contexts (romantic weekend, family stay with a pool, boutique hotel near a convention center, etc.).

We focused on 3‑star, 4‑star, and 5‑star hotels (even though hotel standards are not always consistent across countries).

Here is the list of cities:

- New York

- Los Angeles

- Miami

- Paris

- London

- Rome

- Barcelona

- Amsterdam

- Berlin

- Dubai

- Bangkok

- Tokyo

- Shanghai

- Hong Kong

- Singapore

- Sydney

- Melbourne

- Cape Town

- Cairo

- Istanbul

- Athens

- Mexico City

- Rio de Janeiro

- Buenos Aires

- Toronto

Model Comparison Protocol

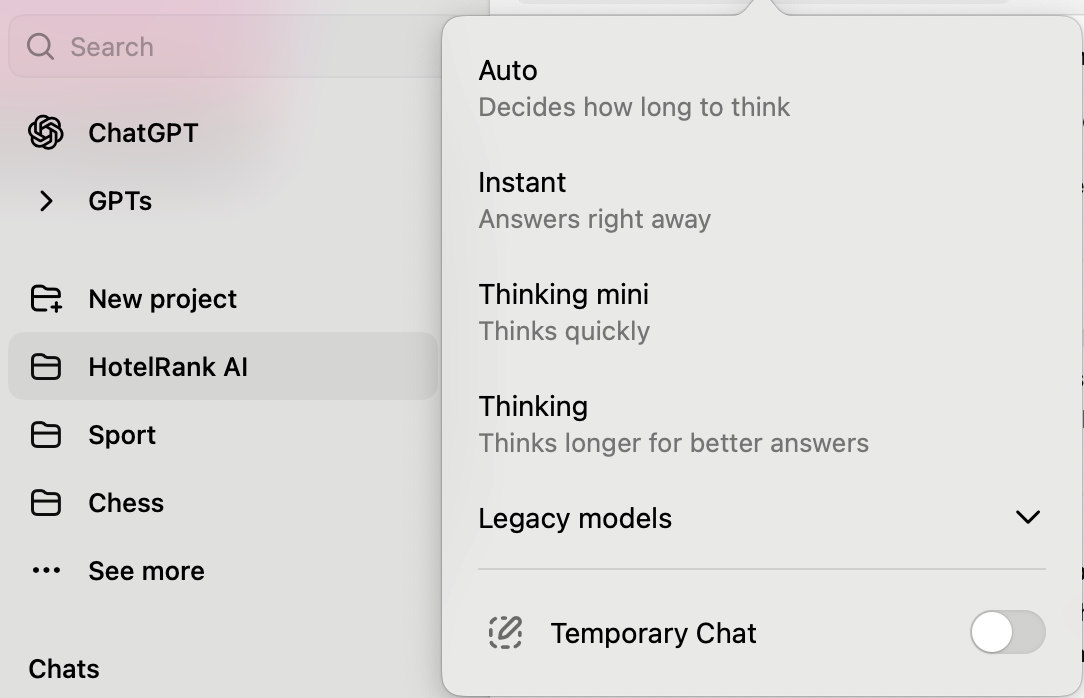

We submitted the same prompts to a selected set of five GPT-5 model variants, including:

- GPT-5

- GPT-5 nano

- GPT-5 mini

These models correspond to the versions deployed in the ChatGPT interface (GPT-5 = Thinking, GPT-5 mini = Thinking Mini), while GPT-5 nano represents the fastest and most efficient version of GPT-5 available via API.

For each AI-generated response, we extracted and classified:

- All hotel-related links, broken down into:

- OTA (Online Travel Agencies) — e.g., Booking.com, Expedia, Hotels.com

- Direct hotel websites

- Model (name)

- Prompt context (persona, city)

Below are our results.

The more the model “thinks,” the more it links to direct hotel websites

In a previous study on link hallucinations, I referenced OpenAI’s September 5th article, which highlighted that GPT-5 hallucinates significantly less—though it still occasionally invents non-existent domains.

Similarly, GPT-5 outputs almost exclusively direct hotel links (over 95%).

By contrast, mini and nano models include OTA links in nearly 30% of cases, revealing a clear shift in behavior based on model size and reasoning depth.

Share of OTA Links by GPT Model (%)

But what’s the real impact for users?

There’s no public data on how frequently each GPT-5 variant is used, but here’s what we can reasonably assume based on performance and integration patterns:

- GPT-5 Nano

No direct impact on users — but likely a significant indirect one. As the fastest and cheapest variant, Nano is often used as the underlying engine for travel agents and API-based assistants.

However, its simplicity means it struggles with more complex prompts — such as detailed hotel searches. This may lead to generic, OTA-heavy recommendations.

- GPT-5 Mini

This is likely the default model for travel-related queries in ChatGPT’s consumer interface. It handles simple requests efficiently.

Given its streamlined nature, it’s not surprising to see up to 30% OTA links in its responses — the model tends to default to mainstream sources to go straight to the point.

- GPT-5 (full model)

This is the version powering advanced travel research — cross-referencing data, performing live web lookups, and handling nuanced requests.

And that’s where the opportunity lies: almost all hotel links are direct. For hotels looking to optimize revenue management, GPT‑5 “Thinking” offers a high-potential channel for direct bookings.

The higher the star rating, the fewer OTA links appear in the AI’s responses

Interestingly, a strong bias emerges in the AI responses depending on the hotel’s star rating:

- A heavy reliance on OTAs (nearly 50%) for 3-star hotels in GPT‑5 mini and nano

- In comparison, GPT‑5 (full) includes OTAs in only 12% of its responses

- The trend continues — though to a lesser extent (~30%) — for 4-star hotels

- And it almost disappears entirely for 5-star hotels

It’s worth noting that some 5-star properties are not listed on OTA platforms, or only appear on a limited number of them.

In France, as of 2024, 3-star hotels represented 48.6% of all classified hotels, and 4-star hotels made up 19.33% (source: INSEE).

This means the observed bias disproportionately impacts the majority of hotels, especially those in the mid-range — and likely extends to 2-star properties as well.

Share of OTA Links by GPT Model and star rating (%)

The type of hotel — and by extension, its budget category — also has a clear impact on the rate of OTA links in AI responses

Similarly, the most budget-friendly accommodations — such as hostels, budget hotels, aparthotels, and eco-lodges — show the highest rates of OTA links, often exceeding 50% in GPT‑5 mini and nano models.

Conversely, luxury hotels, resorts, and boutique hotels are much less frequently linked through OTAs, indicating a clear correlation between price positioning and the AI’s tendency to favor direct versus third-party links.arthotels et eco-lodges — affichent les taux les plus élevés de liens OTA, dépassant souvent 50 % dans les modèles mini et nano.

Share of OTA links by hotel type and model (%)

This also highlights a broader issue of "algorithmic fairness": the lower-budget properties — often the ones most reliant on disintermediation — are also the most confined to OTA monopolies in AI-generated responses.

OTAs for the easy clicks, direct for the serious choices

Leisure-related queries show the highest OTA link rates, while business travelers and elderly users receive significantly fewer OTA links.

This suggests a clear bias based on customer segments, which could pose a strategic challenge for hotels depending on their target audience.

Share of OTA links by persona and models (%)

Booking, the king

Even though Booking.com is likely the most well-known OTA, the numbers are striking: 85% of all OTA links generated by the models point to Booking.com.

Does this hint at a potential partnership between OpenAI and Booking?

We’ll probably find out soon — especially with the recent launch of Instant Checkout and upcoming Shopify integrations, signaling a move toward more transactional AI experiences.

Top OTA domains

Conclusions

- The more the model thinks, the fewer OTA links it provides.

- The higher the hotel’s star rating, the fewer OTA links it provides.

- The higher the budget, the fewer OTA links it provides.

In short: reasoning, rating, and price all reduce reliance on OTAs in AI responses.

Beyond the Findings

How can we explain these biases?

Here are a few hypotheses:

- Training data skewed toward commercial sources, with OTA links more prevalent in general-purpose datasets

- Limited reasoning and contextual understanding in smaller, lightweight models — leading them to default to common sources

- Over-optimization for speed and simplicity, favoring quick, standardized answers rather than nuanced recommendations

- Weaker digital presence and brand visibility among lower-tier properties, making direct links less likely to surface organically

Nicolas Sitter

AI and SEO expert at the forefront of AI Search. He analyses models daily and runs hospitality-focused experiments on a database of over 1M prompts, citations and mentions.

Co-founder of Hotelrank